Why did Trump Backdown from His 2 April 2025 Threats this Week?

Most of the media bought the hype and missed the TACOs on the deadline and rates.

By Richard Baldwin, IMD Business School, Factful Friday, 11 July 2025.

Introduction.

This week, President Trump delivered a TACO value-pack. In April, Trump promised very high tariffs. By July, without getting concessions, he backed down on many of those promised tariffs, and he also backed down on his 9 July deadline.

But still, while they are delayed to 1 August, this week’s tariffs rates are dramatically higher than those in place – often twice what they are today. That suggests that the President is winding up to deliver a gut-punch to the American economy in a few weeks. Either that, or, another TACO value-pack. My money’s on the later.

This week’s Factful Friday digs into why President Trump backed down unilaterally on rates and deadlines without winning concessions, and why he is likely to TACO again as the end of the month approaches.

A closer look at the TACO value pack.

If you actually watched what happened, and had a memory that stretched back 90 days, you saw:

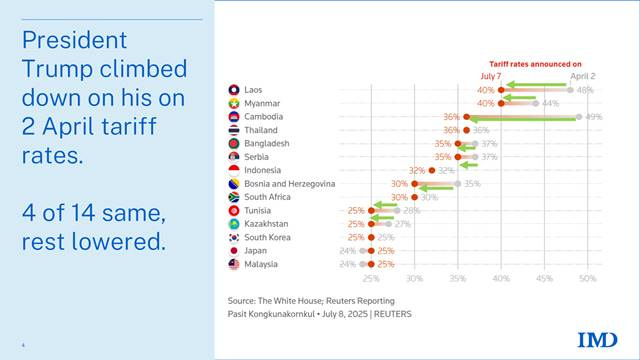

Without winning any concessions from any of the 21 nations, President Trump unilaterally climbed down on tariffs for 12 of them – announcing rates below the ones that he set in his 2 April Executive Order (see chart for the 7 April rates).

I count that as 12 TACOs (chickened out on his threat to impose 2 April tariffs if nations didn’t make concessions to the US). Admittedly, there were not massive TACOs. Not the TACO GRANDE he showed us 9 April, but they were TACOs nonetheless.

2. Without gaining any foreign concessions, he chickened out on his deadline, pushing it back to 1 August.

Both actions made it seem like the President was back to negotiating with himself, as I pointed out in my 16 April 2025 Factful Friday. Announce tariff rates and then, without obtaining any foreign concession, lower the rate. That’s not how trade talks usually go.

So that’s how this week was a massive TACO and a massive tariff rise. It’s a TACO from the perspective of the 2 April 2025 promises, but a huge tax hike from the June 2025 perspective.

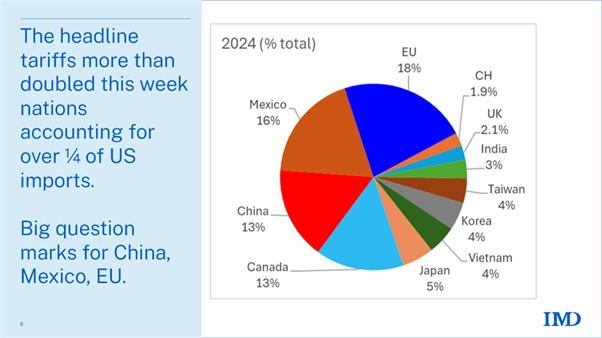

To sum up, if you compare the announced tariffs to what they were in June, they more than doubled the headline rates (which were 10% in June) for the big importers like Japan, Korea, Canada, and Vietnam. We are still waiting for the numbers on India, Mexico, and the EU, but the pattern suggests that they won’t be less than 20%, and more likely 25% or more. See the chart below for import shares.

The spin master won again.

A value pack of TACOs is not how his announcement got picked up in much of the media. POTUS, who is a master of spin and misdirection, made himself look stern and determined, but also wise and magnanimous.

He moved the day before the deadline he set for himself to avoid having to admit one of two failures.

His negotiating team is either understaffed, or underqualified to accomplish the promised 90 deals in 90 days (or the goal was ridiculous to start with).

Foreign countries ignored him and his deadline and didn’t deliver the concessions he claimed that they were dying to make.

By acting on 7 July instead of allowing the deadline to expire, he made it look like he was in control.

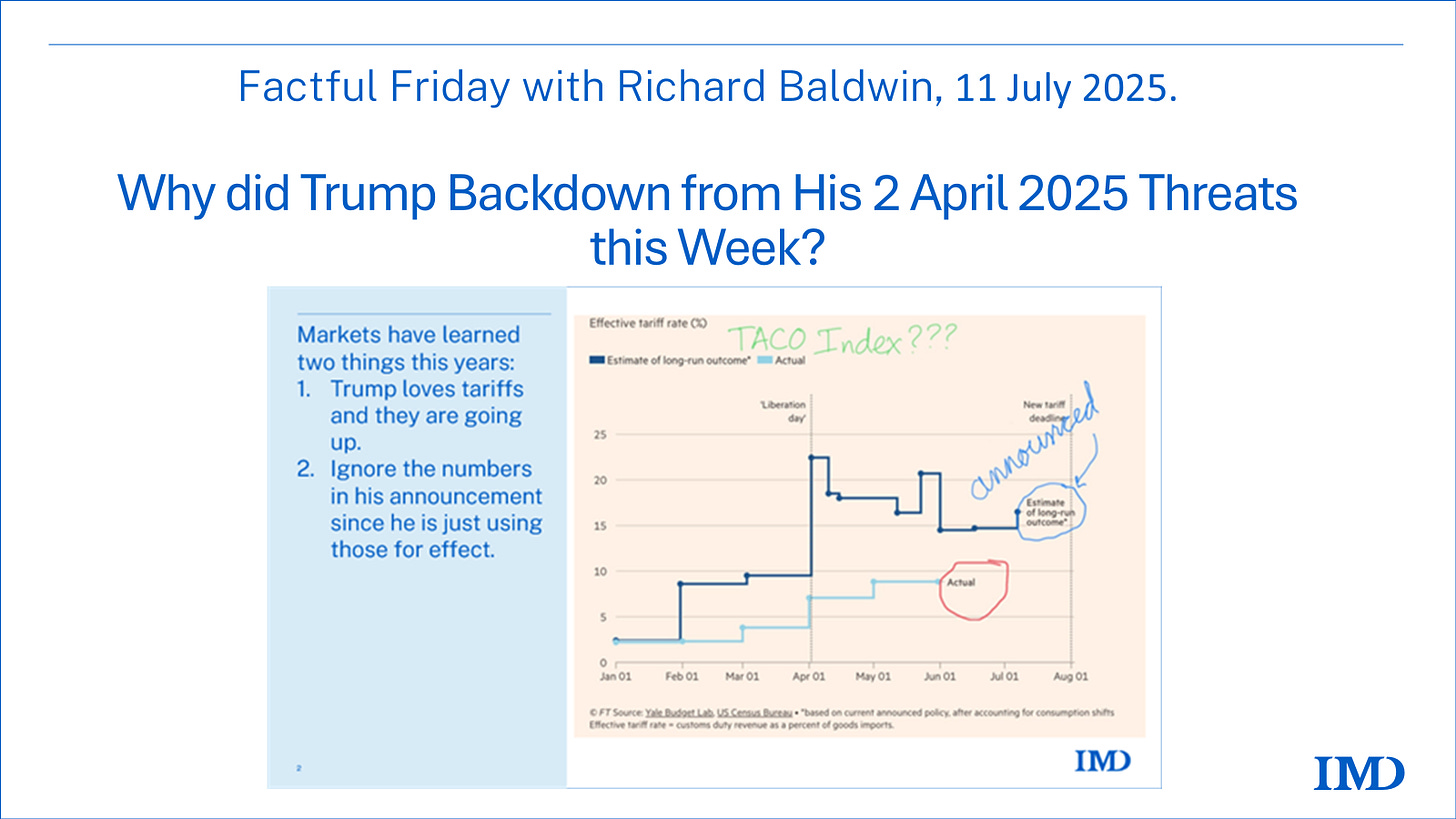

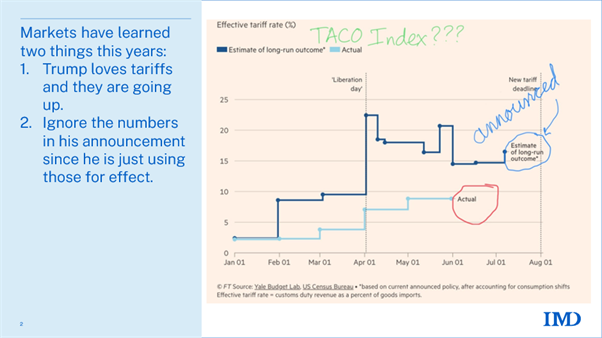

Markets saw what was actually happening (TACO as expected).

Markets hardly reacted because what happened this week was less bad than he promised in April. Moreover, the markets have got the hang of the TACO trade (see the chart), so it self-extinguished – as all arbitrages do once everyone knows about them. The shock announcement would have lowered markets as some investors bailed but the bulk of the market saw any softening as a buy-the-dip moment, and the market hardly moved.

So, why do I think POTUS will TACO at the end of July?

Why won’t POTUS carry through with his July tariff threats? Price hikes are Hurting His Base.

Inflation is up, but only by a tiny bit. The latest official data shows a bump from 2.3% to 2.4% between April and May. There may be more coming if the tariffs settle into something more like 20-25% on most imports, but even then, the impact cannot be huge, and this for three reasons:

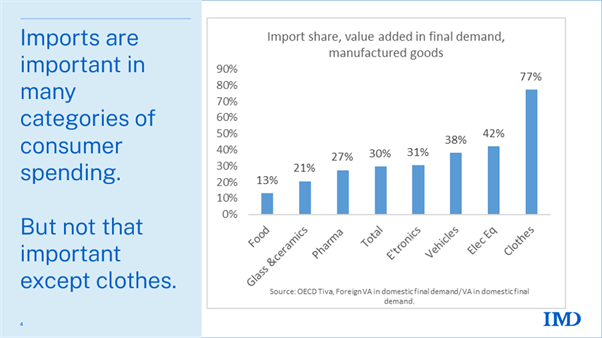

1. The US is a quite closed economy; imports are less than 15% of GDP.

2. Tariffs only fall on goods and goods count for only 30-40% of the standard inflation indices (see table).

3. As the chart below shows, apart from clothes and shoes, imports are not a huge share of the final consumer demand in the US (see point 1).

So, if you put all that together, the tariff could get you a midinflation bump, but that hasn’t happened yet.

Consumers expect a doubling of inflation rates.

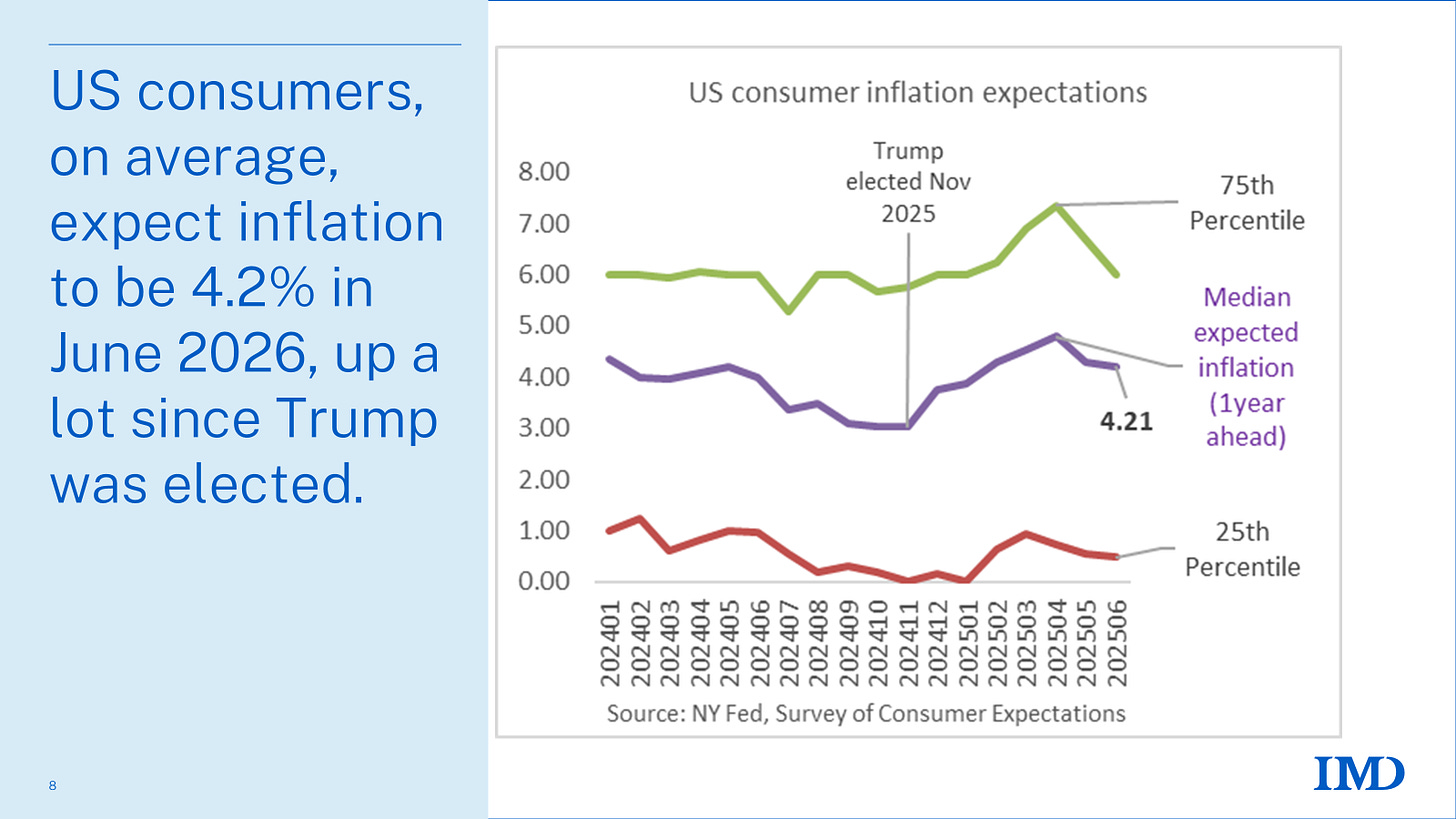

Mainstream forecasters are suggesting that US inflation will rise from 2.3% today to above 3% for the whole of 2025. US consumers are much more pessimistic about it.

As the chart shows, since President Trump was elected in November 2025, consumer inflation expectations have risen substantially. The latest data shows the median expectation is 4.2%, which is more than double the Fed’s target.

But it’s not just the CPI that matters.

The President’s base doesn’t care about CPI figures. They care about how much stuff costs them. They care about their cost of living.

But wait, you might say if you know enough macro. Are CPI and PCE indicators of the cost of living of the average American?

Yes, but. Experience shows that people tend to focus on the price of goods they buy frequently. Many of the services they buy – ranging from rent to Netflix subscriptions – are on autopilot, so the average consumer doesn’t see those price everyday or every week. Remember the fascination with the price of eggs? Inter alia, that was because people buy them frequently.

For example, the ECB and Eurostat publish a special inflation index that tracks prices of goods frequently purchased by consumers, such as food, fuel, and personal care items. This measure – called the “Frequent out-of-pocket purchases” Harmonised Index of Consumer Price (HICP) – more closely reflects how people actually feel about inflation, especially for lower-income households, since it focuses on everyday essentials rather than infrequent big-ticket purchases, or contractual services.

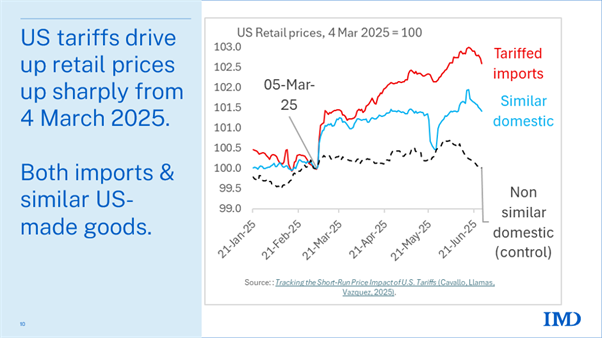

Recently updated research by Cavallo et al at Harvard Business School shows that retail prices have already risen in reaction the tariff since 4 March 2025 (which is when tariffs on China went up a lot).

Broken promises: He said he’d lower prices, but they keep going up.

Inflation was a major issue for the middle class during the 2024 election. Naturally, given the historic inflation surge in 2022. To ride the resentment, candidate Trump promised he’d lower prices:

"Starting on day one, we will end inflation and make America affordable again." - Donald Trump, August 2024 rally in Montana

But that wasn’t going to happen as he admitted just after he won. When asked about whether he would deliver on his promised price reductions, he said:

"I don't think so. Look, they got them up... I'd like to bring them down. It's hard to bring things down once they're up. You know, it's very hard." – Donald Trump, December 2024 interview with Time magazine

And he even linked his tariff to price rises. During the 30 April 2025 Cabinet meeting, he said that his tariffs could lead to more expensive products, remarking:

"Maybe the children will have two dolls instead of 30 dolls," and added, "So maybe the two dolls will cost a couple bucks more than they would normally." - Donald Trump, 30 April 2025.

With this very memorable quote, the President put his fingerprints on the tariff-linked price rises we have already seen.

Summary and concluding remarks.

This week’s tariff announcements were both huge tariffs hikes and a huge climbdown.

We saw a week where the President delivered a value pack of TACOs. 90 days ago, he promised he’d put up tariffs from the current most common 10% level to the stratospheric 2 April 2025 tariffs. It wasn’t an offhand comment. He promised it in an Executive Order. The only condition under which he wouldn’t do it was if countries “bent the knee” and made sufficiently large, unilateral concessions to the US.

All but two nations called Trump’s bluff. The was to be expected; they’d seen a continual stream of TACOs while US economic growth softened and US prices rose. They could do the maths. The existing tariffs were hurting the President’s base. And increasingly so the import taxes had time to work their way through to retail prices. Wait-and-see was the dominate strategy, once they understood that the US President was following what I called the Grievance Doctrine in my May 2025 eBook, The Great Trade Hack. Under Trump’s 'Grievance Doctrine’, tariff announcements aren’t about economics. They’re about emotional satisfaction. Showing toughness, fighting back against foreigners, and looking strong. He needed to sound tough, and make it seem like he was hitting back at

But the 7 and 9 July tariff hikes, announced in letters to foreign leaders, were often two or three times what the headline rates were in June. Markets barely reacted meaning that they either don’t believe he’ll actually raise the rates in August, or that they thought he would raise them to the promised levels and were relieved that many of the July were lower.

The second aspect of his TACO was the extended deadline. He pushed it to 1 August from 9 July. That sets up conjectures about what happens when the calendar crosses the deadline.

What would Grievance-Doctrine-thinking conjecture? First, it is all about the President looking strong and standing up against the thieving globalist elites. Or, as he put it:

"It's about time the United States of America started collecting money from countries that were ripping us off ... and laughing behind our back at how stupid we were," – Donald Trump April 2025.

On this score, his July announcements were mission accomplished. The media almost universally followed the spin and showed Trump as winning against the foreigners. But part of the Grievance Doctrine is that he doesn’t want to hurt his base. The outrageously bold tariffs are to make the feel better. Not make them poorer.

So, I guess we’ll see a stretched out version of the 2 April versus 9 April Donald Trump. On 2 April, he bold, outrageous and his base loved it. On 9 April he almost completely TACO’s. He put almost all of them to 10% or less.

Will he do the same as 1 August approaches? I am guessing he will.

Looking ahead, don’t be surprised if another TACO value pack is served up in the final days of July.

The reason is simple. Trump knows that the very high tariffs he announced in July are politically toxic for his base.

Inflation expectations among US consumers continue to rise and the are seeing price rises in the aisle of Walmart and pages of Amazon. And at least some of them will remember his campaign promises to bring prices down.

Uncharacteristically, the President admitted that prices are “very hard” to bring down and people may have to pay $2 more for their dolls. This means, I believe, that any tariff-driven cost of living increases will have Donald Trump’s fingerprints all over them in the eyes of voters.

I expect a theatrical rerun of the 7 July performance. Another walk-back of tariffs (especially for friendly nations) down toward the 10% range, packaged as a “victory” in imaginary negotiations.

Trump will declare that America has struck “fantastic deals,” that foreigners are falling into line, and that globalist elites are finally showing “respect” to the US.

China, however, is a different kettle of fish. Beijing holds stronger cards as I pointed out in my 20 June 2025 Factful Friday column, “Asymmetric Geopolitical Warfare.”

With rare earth magnets as leverage, China can the US where it hurts. I wouldn’t be surprised if the Chinese forced Trump to soften his 20% fentanyl tariffs, spinning it as a big win for America. The Chinese might even get America to unwind parts of Biden-era tech restrictions on advanced AI chips and semiconductor exports.

As the Chinese showed on 14 May 2025, they know how to take a win while allowing President Trump to have ‘happy headlines’ (see my Linkedin Post on this).

So, brace yourself for a TACO deluge in August. In my view, the tariffs will shrink, and the spin will soar because even Trumpian political theatre can’t mask sticker shock.

The tariffs President Trump announced this week were a massive tax rise on imports, but they were also a chicken-out by the President. How can they be both? Consider the TACO (Trump Always Chickens Out) aspect.

This week delivered a real TACO value-pack, if you compare the announced tariff to what President Trump promised to do in his 2 April 2025 Executive Order.

If you compare the announced tariffs to what they were in June, they more than doubled the headline rates (which were 10% in June) for the big importers like Japan, Korea, Canada, and Vietnam. We are still waiting for the numbers on India, Mexico, and the EU, but the pattern suggests that they won’t be less than 20%, and more likely 25% or more.

So that’s how this week was a massive TACO and a massive tariff rise. It’s a TACO from the perspective of the 2 April 2025 promises, but a huge tax hike from the June 2025 perspective.

And that’s it for another Factful Friday!