By Richard Baldwin, 15 July 2025.

Introduction.

President Trump is a master of spin. Magicians distract you with one hand while the other hand pulls the trick. That’s what POTUS does routinely. It’s amazing how often he as threatened tariffs, failed to follow through, and then made another threat. And yet he still manages to spin it as a show of strength. And much of the media buys it.

The EU tariff case.

Nowhere is this misdirection clearer than in his 2025 tariff threats on the EU. What looks like escalation is often actually retreat in disguise.

This short post lays out the facts using two simple timelines:

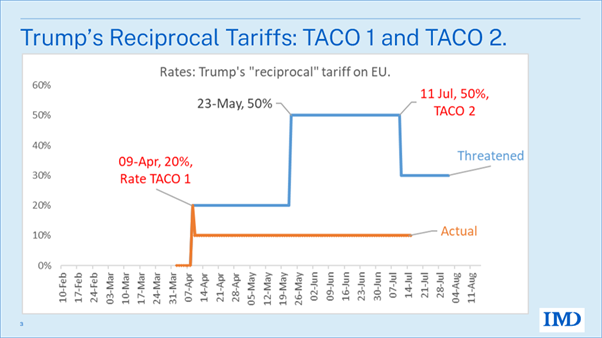

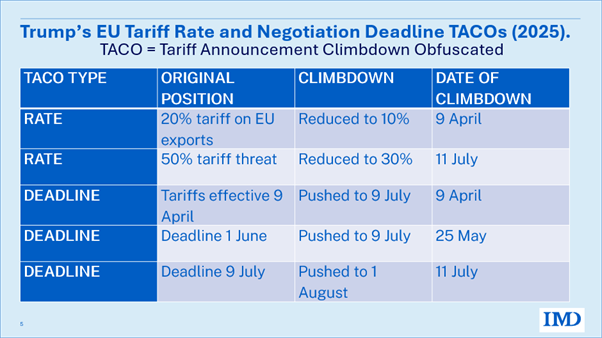

One showing how Trump’s threatened tariff rates on the EU were walked back not once, but twice.

I call these “Rate TACOs”, 1 and 2.

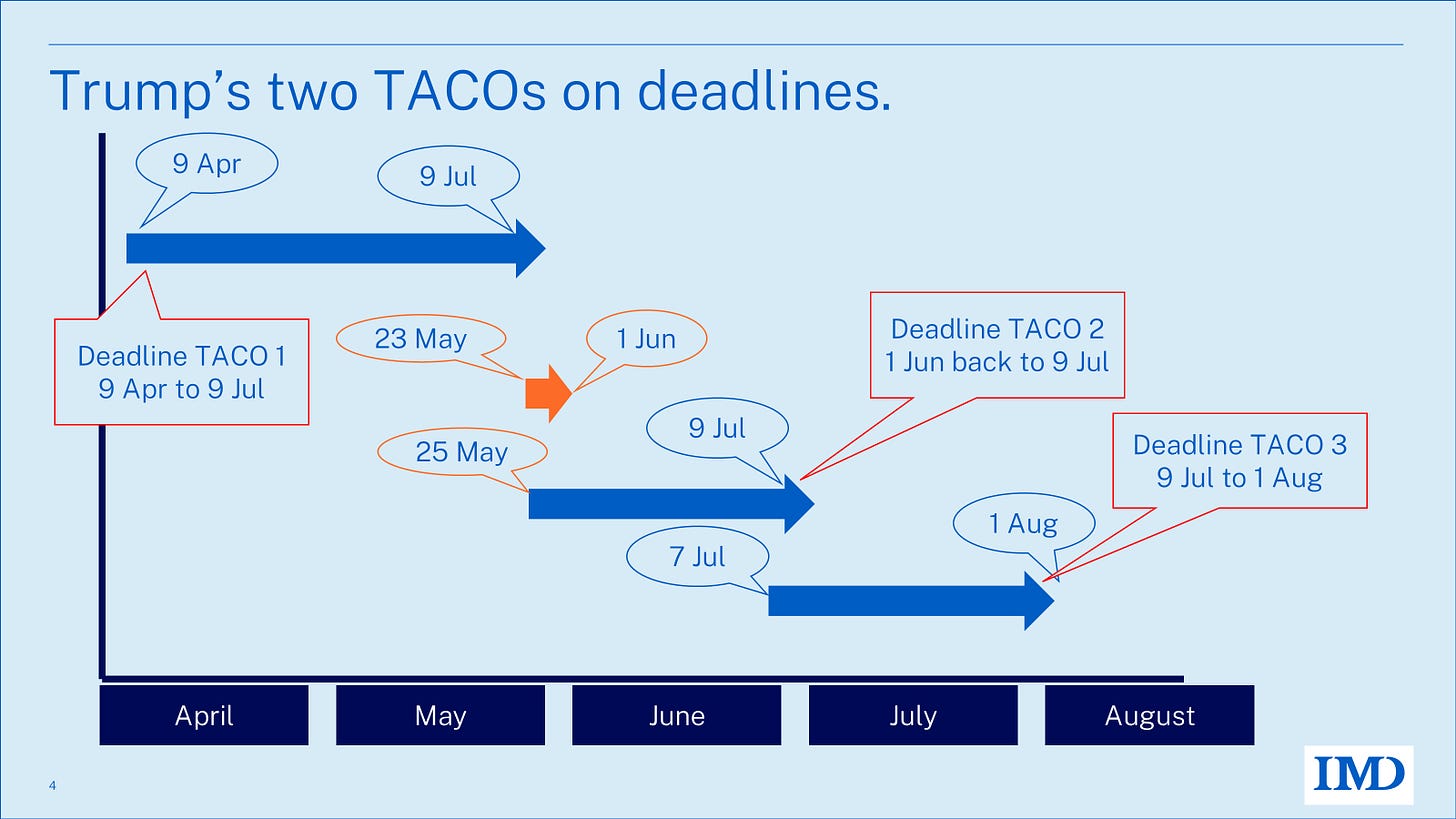

Another timeline shows how he backed off deadlines, each time softening his position while claiming victory.

I call these the “Deadline TACOs”, 1, 2, and 3.

The TACO Grande, 9 April.

Let’s start with the greatest TACO of all.

The first big retreat came on 9 April, a week after his famous 2 April 2025 “reciprocal tariff” Executive Order that created chaos around the world and especially in financial markets. As far as the EU is concerned, they were to get 20% tariff on all EU exports. And indeed the President carried through with his threat.

The 20% tariff came into effect one minute past midnight on 9 April, but Trump retreated by lunchtime, reducing it to 10% and pushing the deadline back to July 9. This 10% was for everyone, exempting only China.

That was Rate TACO No. 1, and Deadline TACO No.1. It was a really big TACO. The EU’s 20% tariff became 10% with a threat to switch it back up to 20% if the EU didn’t do a trade deal with the US by 9 July.

Then came the next TACO, subtler but equally revealing.

On 23 May, Trump dramatically raised the stakes, threatening a 50% tariff on the EU unless a deal was struck by 1 June. That was so aggressive! So media-attention grabbing! Wow. Raising the threat from 20% to 50% and moving the deadline up to 1 Jun from 9 July. Naturally, it was covered as showing how the American leader was so strong and determined.

Deadline TACO No. 2.

But then reality hit. There was no way the EU and the US could strike a deal in a week, and there was no way Trump wanted to put 50% tariffs on its largest provider of imports when his base was already suffering from rising prices due to his huge tariffs on China (where he had TACO’d on 12 May). So he TACO’s on the deadline but not on the rate.

On 25 May, two days later, came Deadline TACO No. 2. He pushed the 1 June deadline back to 9 July.

Deadline TACO No.3 and Rate TACO No. 2.

For a variety of reasons, most of America’s trade partners slow-walked the negotiations. The EU did too.

When 9 July came and went without a deal and no carrying through with the 50% threat, POTUS was faced with a new reality. The EU had called his bluff. What was his next move?

On 11 July, two days after he should have imposed the threatened 50% tariff, President Trump sent a scary-sounding letter to the EU. Most of the press picked it up as showing how the American leader was so strong and determined. But in fact, the EU’s letter was a double TACO.

President Trump TACO’s on the rate, lowering the threat from 50% to 30%. President Trump TACO’s on the negotiation deadline, pushing it from 9 July to 1 August.

In other words, the threat escalated from 20% to 50% — then got quietly walked back to 30%, with another deadline delay tossed in for good measure.

Summary of the TACOs.

Trump’s tariff threats don’t just shrink in size, they slip in time. Again and again, his “hard deadlines” dissolve into delays. Each time, he sells the retreat as strategy. But once you line them up chronologically, a pattern of bluster and backpedaling becomes obvious.

Three TACOs. Three goalposts moved. Each time, the deadline was portrayed as firm, until it wasn’t.

Does TACO stand for Tariff Announcement Climbdowns Obfuscated?

One puzzling aspect of this whole history is the failure of the stock markets to take the Trumpian misdirection bait. The media’s frenzied reporting was matched by a sort of +/-0 market move.

But now you can see that the market moves make sense. They kept their eye on what Trump was actually doing rather than on the misdirection that the media followed.

From 2 April to today, POTUS has showed us two undeniable things. First, he is really keen on putting up tariffs. Second, when the tariffs directly harm his MAGA base in ways that they are likely to realise, he backs off. On steel and aluminium, where the price-rising effects are probably too indirect to be blamed on him by his base, he went ahead with 25% and then 50%. On autos, where the tariff could be easily seen, we saw Trumpian TACOs galore. As the law firm Pillsbury put it:

On March 4, 2025, at 12:01 a.m. EST, a 25% tariff was applied to all imports from Canada and Mexico, with a reduced 10% duty on Canadian “energy and energy resources.”

On March 5, 2025, in response to concerns raised by U.S. automakers, the Trump administration stated it would pause application of the 25% tariff for imports relating to that industry.

The following day, after discussions with his Mexican and Canadian counterparts, President Trump published executive orders pausing IEEPA tariffs with respect to all USMCA-compliant Canadian and Mexican imports until April 2, 2025. The orders also reduce the tariff for potash that is the product of Canada or Mexico but does not meet the USMCA rules of origin to 10% in response to concern from agricultural producers. All of the foregoing was implemented through regulatory actions that took effect on March 7. – Pillsbury, 10 March 2025 Alert.

Summary and closing remarks.

My point here is simple. President Trump’s headline-grabbing threats obscure the fact that he has been backing down continuously. Since 2 April, each new threat to the EU has been a retreat repackaged.

To see the real story, you need to track the timeline. And when you do, one thing becomes obvious: Trump’s tariff credibility is fading with every new announcement. Not with his base perhaps, but with markets, trade partners, and attentive negotiators. Each new announcement lands with less weight than the last. Each “red line” becomes a moving target. And each climbdown makes the next threat easier to ignore.

That’s the TACO effect. And once you see it, you can’t unsee it.

real economic analysis by a real economist