Could the EU Repeat China’s Win Against Trump’s Tariffs?

Europe has the leverage to force an escalation and subsequent US tariff climbdown, but “can” doesn’t mean “should.”

By Richard Baldwin, 13 July 2025. Factful Friday come early.

Introduction: The Chinese Precedent.

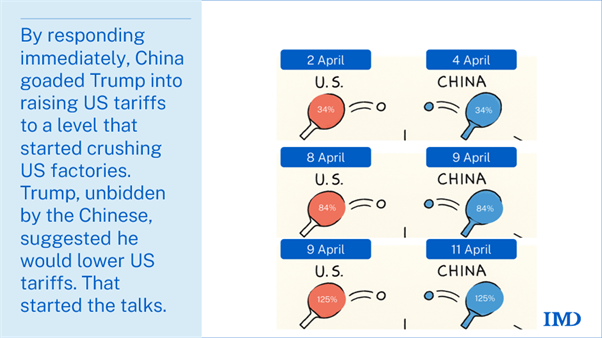

On 2 April, President Trump said he would put a 34% tariff on Chinese goods by 9 April. China didn’t wait. They retaliated immediately with a matching 34% on US imports.

This triggered a cycle of counter-retaliation. The result was a business-crushing 125% tariff added to existing tariffs. Both ways. The US put on 125% more. China put on 125% more.

Which of these tariffs did the most damage to President Trump’s political base? The US 125% or the Chinese 125%?

If you believed the spin by POTUS and the hype in the media (based on experience with standard trade wars), it was the Chinese tariff that hurt America. But you would be wrong.

The real damage to America’s economy was what the US tariff on China was doing to American manufacturing. As I pointed out in my 2023 Brookings Paper, many US factories can’t run without Chinese parts and components. The damage wasn’t caused by Chinese retaliation. Rather, it stemmed directly from the US tariffs themselves by making critical Chinese industrial inputs sky-high expensive.

By early May, American factories were shutting down, layoffs were mounting. As this 5 May 2025 story in the Wall Street Journal shows:

Ford expected that tariff-related costs would shave around $1.5 billion off its adjusted pretax earnings. Automakers from Tesla to General Motors are scrambling to adjust to Trump’s tariffs on automobiles and car parts. “President Trump is expected to soften the impact of his automotive tariffs on Tuesday. He said automakers should not be ‘penalized’ if they can’t get car parts.” - Wall Street Journal 5 May 2025.

This can be seen in the chart below as a massive drop in the shipping of containers from China to the US.

US consumers were also hurt. Prices at Walmart, Amazon, and other major retailers were up as Harvard Business School research showed.

The narrative trap POTUS built and fell into.

By May 12, Trump faced a dilemma.

With domestic pain intensifying, he needed to reduce the business-busting 125% he had added to the cost of importing from China.

But the political motive behind his 2 April war on the trade system wouldn’t let him do that.

Trump’s tariff escalation wasn’t harming China nearly as much as it harmed his own political base. America’s manufacturing sector and working-class voters (core Trump supporters) relied heavily on affordable Chinese industrial inputs.

But the President couldn’t remove them unilaterally without looking weak. Trump needed China to remove their tariffs as well, so he could spin his climbdown as a victory. He had to make it look like his 2 April tariffs were the leverage he used to get China to reverse the rip off.

This is an unusual point. Yet is perhaps the most important lesson that other nations, including the EU, should draw from the way China force Trump to back down on his 2 April tariffs.

Since it was the US that put the recession-inducing tariffs on China, the US could have – technically speaking – removed them unilaterally.[1] But the technical solution was politically impossible. Think of this as a “narrative trap”.

Think hard about that for a moment. Trump built a tariff wall that he thought was for leverage. But when the Chinese matched his tariffs, and the leverage got reversed because US manufacturing needed Chinese inputs. The grievance doctrine had given China the upper hand. And as May rolled on, and the US economic pain deepened, China’s hand got stronger.

Ironically, Trump had put himself in a position where only China could save him from the rage-driven, outrageously high tariffs that were hurting America.

His first reaction was to bluster, bluff and bully. He repeatedly pretended that the Chinese President had called him. He repeatedly urged China to make the first move to reduce tariffs. But China knew all they had to do was wait since the tariffs were damaging President Trump’s political standing much faster than they were damaging President Xi’s.

Trump desperately needed an off-ramp, but the political optics demanded China ask for talks. Beijing, understanding this, refused to oblige.

To avoid a further deterioration of the situation in American manufacturing, Trump capitulated in order to end this you-ask-first standoff. That was on 9 May. POTUS unilaterally announced that the US could lower tariffs to 80% – even before the talks began.

This unilateral admission that US tariffs had to come down gave President Xi the face-save he needed to start talks with the US. After just two days of talks in Geneva – over the weekend of 12 May – the two sides announced a deal that removed 115 of the 125% they had put on since 2 April

Trump’s quick retreat was a diplomatic victory for China. But Beijing wisely and cleverly masked its victory by allowing Trump to spin it publicly as a win.

For analysts that could see beyond the spin, this climbdown signaled to the world that Trump’s tariff strategy was not only reckless, but vulnerable.

How China’s strategy worked and why.

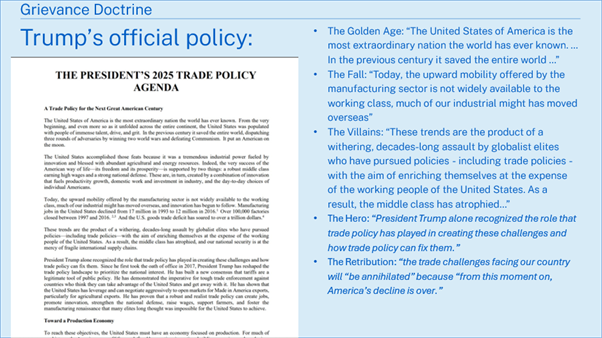

To understand how China won, and how the EU might replicate its victory, we must first understand why Trump raised tariffs to economically disastrous levels in the first place. This wasn't a carefully calibrated strategy. Rather, it was driven by what I call the Grievance Doctrine: Trump’s policy is rooted not in economic reasoning, but in a deep-seated sense of victimhood and resentment toward foreign competitors.

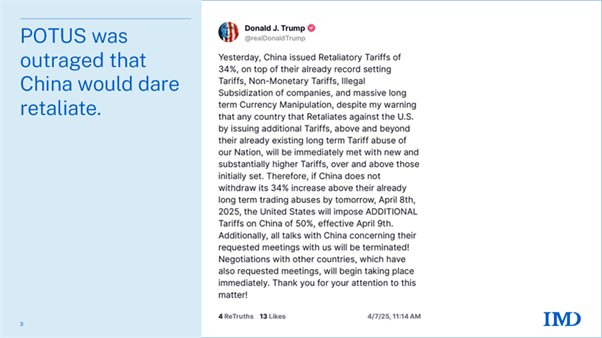

Each Chinese retaliatory move aggravated Trump’s sense of grievance, prompting further tariff hikes. This grievance-driven cycle rapidly escalated tariffs to unsustainable levels, not because it made economic sense, but because Trump was outraged that the thieving foreigners would dare fight back and thereby deepen the victimization of America.

Now when I use words like “thieving foreigners”, I sense that it is unprofessional. But we all have to get over this reluctance. Trump’s trade policy follows an emotional logic, not an economic logic.

Grievance Doctrine.

His actions then, and now, are driven by what I called the “Grievance Doctrine” in my May 2025 eBook, The Great Trade Hack.

To the President, tariffs are not about economic policy, they are about getting even for the decades during which, in his view, the trade system victimized America.

That is surely hard for analysts to accept. But don’t take my word for it. It's all written down in chapter 1 of The President's 2025 Trade Policy Agenda. See below.

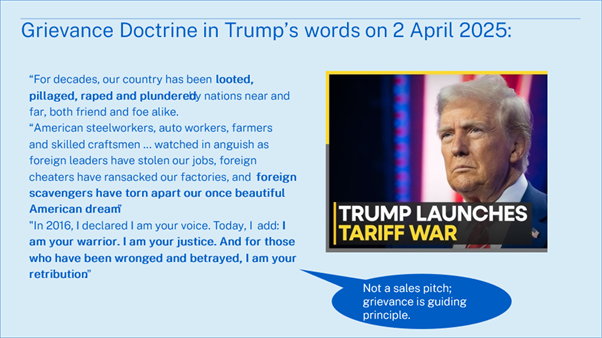

Grievance and the driving motivation for Trumpian trade policy is also crystal-clear in his 2 April speech. You can see below some quotes that make it sound like he is talking about war crimes, not trade policy.

Could Europe pull the same trick using its supply-chain leverage over US manufacturing?

The obvious question is: Could Europe similarly leverage Trump’s grievance-driven tariff escalation into a decisive economic and political advantage?

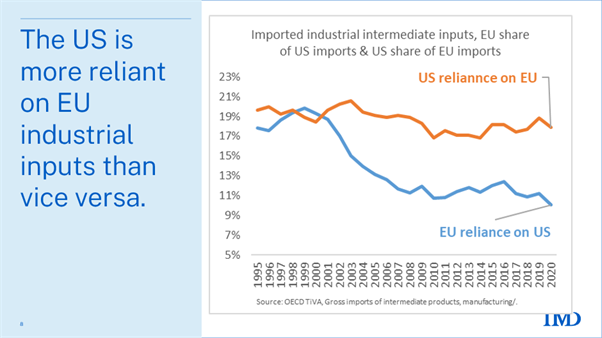

Economically speaking, the answer is clearly yes. EU-US economic interdependence is strikingly similar to the US-China case.

Contrary to popular perceptions, Europe doesn’t simply export luxury products or high-end consumer goods to the US. It also provides American manufacturers with essential industrial inputs. Indeed, after China, the EU has the greatest supply-chain leverage over President Trump.

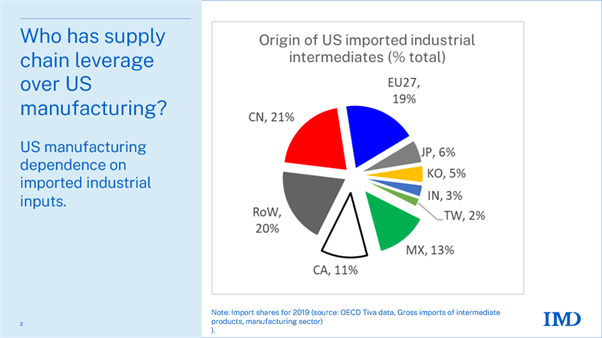

As the chart below shows, China is the number one supplier of American imported industrial inputs, but the EU is number two. The chart also shows why Canada and Mexico have been treated so differently. Goods that enter the US from North America get duty-free treatment is they are part of US manufacturing supply chain – namely, those that are compliant with the North American trade deal, USMCA. Other biggies in the manufacturing world, Japan and Korea, are much less central to operation of US factories.

The machinery and chemicals levers.

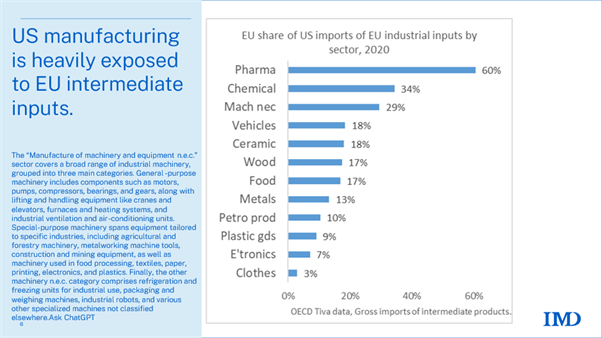

Two sectors stand out sharply in this regard: machinery and chemicals. Together, these industries form the industrial backbone of the US economy, and Europe’s leverage over them is substantial as the chart below shows.

Take machinery. American factories rely heavily on European precision machinery which includes everything from specialized factory equipment to sophisticated components and industrial control systems. They’re not commodities that can simply be sourced from elsewhere overnight. Disruption in these imports could, as happened in April and May with Chinese inputs, cause factory slowdowns, production halts, and layoffs.

Even more striking is Europe’s share in the chemical sector, where it supplies over a third (34%) of all US chemical imports. European chemical companies provide specialized intermediates and advanced chemical formulations that serve as crucial inputs for a wide range of American industries. US vulnerability is even greater in pharma, but so far POTUS has exempted this, probably because he knows the US is so heavily dependent on foreign drug makers. This economic vulnerability is precisely what gave China leverage.

Europe can probably win an economic arm-wrestling match, but can and should are pretty different things in this setting. I’ll talk a bit more about this below, but first I’d like to review the retaliation that Europe is now contemplating.

EU retaliation already announced.

EU retaliation against Trump’s tariffs is not new. The EU tariff retaliation gun is already loaded, and ready to fire. But this is an air pistol, not a Glock.

The first of the two-part retaliation (announced 12 March 2025) would hit only about $20 billion of the $300 billion plus US exports to the EU. The second part would hit another $100 billion or so.

This is nothing like the Chinese retaliation (125% on all US exports to China). But it still might provoke POTUS into a rage-driven escalation that put him back into the narrative trap.

Summary and closing remarks.

The economic case for the EU retaliating against Trump’s tariffs is clear. Europe’s substantial leverage in strategic sectors like machinery and chemicals could – eventually – pressure POTUS into negotiating with the EU to reduce their mutual tariffs.

If this tariff arm-wrestling remains strictly in the trade domain, Europe’s hand is strong—potentially decisive.

The “if” in that sentence is doing a lot of heavy lifting.

What might start as a trade war could escalate into threats to NATO, reduced security cooperation, or even the withdrawal of US troops from Europe. That would not be good. See my long-form thoughts on this in my 25 May 2025 Factful Friday.

It is exactly this sort of dilemma that keeps European politicians staring at the ceiling as they try to fall asleep (Ok, maybe that was a bit too vivid?). Europe cannot allow itself to appear weak, nor can it afford a reckless escalation that threatens decades-old transatlantic security structures.

Now the question is:

Should the EU, as China did in April, immediately retaliate, thus goading President Trump into raising US tariffs up to levels that will hit American factories with slowdowns, layoffs, and shutdowns?

That question is above my pay grade, so I’ll just leave it there for those who get paid to answer such questions.

I agree with what you’ve said but isn’t there a genuine grievance? I mean how much longer can the world sustain Western economies with chronic trade deficits, & China with a huge surplus? And isn’t it fair to suggest that a lot of global trade infrastructure was built by the US? Michael Pettis suggests capital inflow taxes but an alternative is to charge an ‘infrastructure tax’ for using these systems. Of course this will hasten the development of alternative trade infrastructure but that would be good for the US in the long run.

The problem with Trump is he thinks he can have his cake & eat it. Like many emperors before him. But I’m not sure we should be cheering the defeat of his policies. Surely the world needs the US to be healthy, prosperous, stable & able to provide for its people? The trade deficit is a real problem & even though tariffs are a circular firing squad for a net importer, the underlying issue hasn’t gone away? We have a global system without global rules funded by a monetary pump.